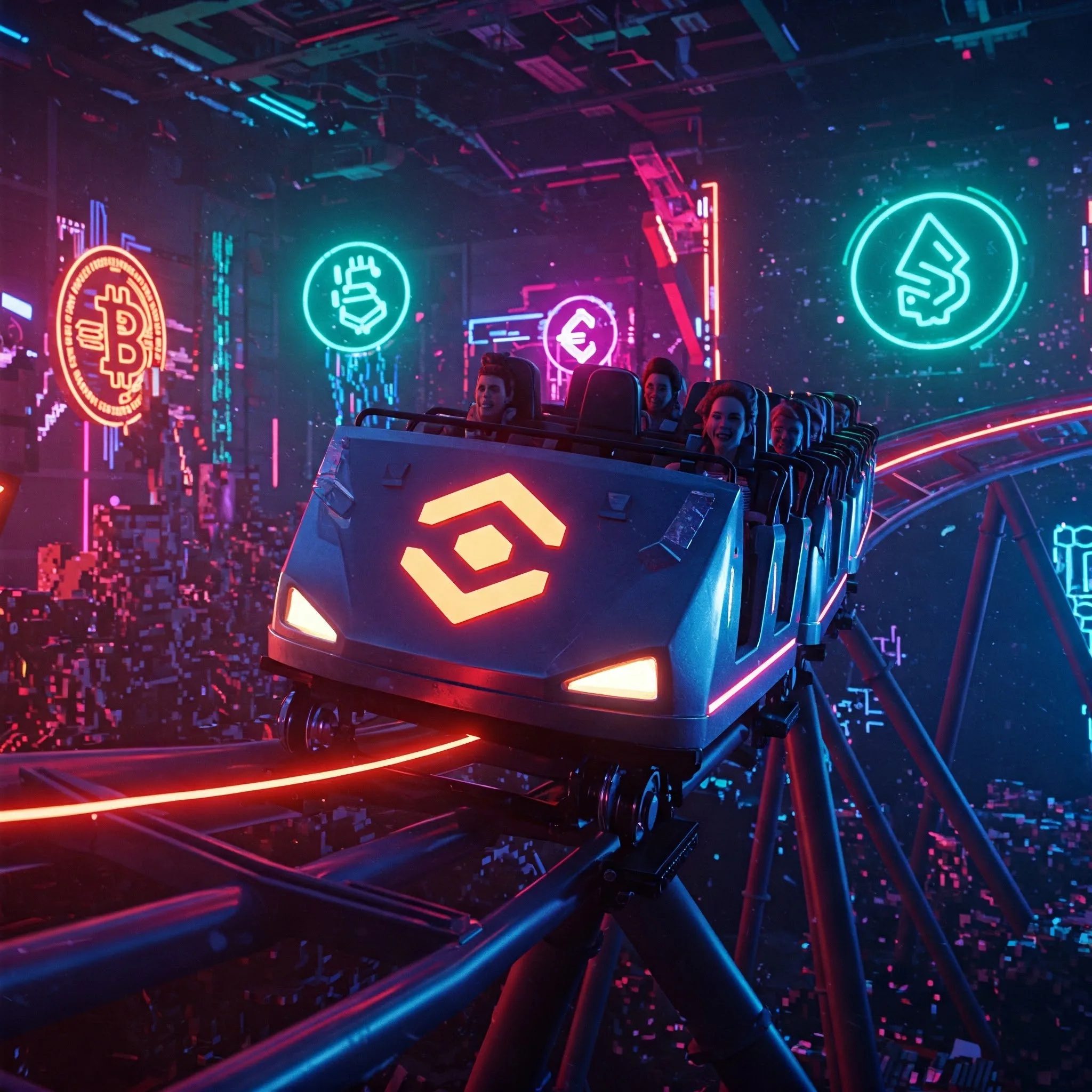

Welcome to another roller-coaster ride on The Awesome Blog! Today, we’re diving headfirst into Coinbase, the crypto titan that swings wilder than your uncle at karaoke night. Buckle up—it’s about to get hilariously informative!

Coinbase’s Stock: Like Bitcoin but with Extra Spice

It’s simple—Coinbase stock is crypto’s volatile glam-rock cousin. Bitcoin sneezes, and Coinbase catches pneumonia. Coinbase stock surfs the waves of Bitcoin prices, regulatory hiccups, and investor emotions quicker than influencers chasing trending hashtags.

And now, because plain old volatility wasn’t enough, enter leveraged ETFs! Imagine betting not just on the rollercoaster but on quietly doubling the ride’s loops. Potential high returns? Check. Potential breathtaking losses? Double-check! Proceed with caution—or a seatbelt.

Surviving Regulators: Coinbase’s Ongoing Soap Opera

Regulation in crypto land is like your mom showing up at a wild party—total buzzkill. Regulators want to tidy things up, cut back on shady business, and mainly ensure investors don’t lose their life savings on ‘Captain Eloncoin.’ Coinbase has wisely responded by schmoozing the regulators, investing tons in compliance, and keeping lawyers happier than kids in a candy store.

Sure, it’s painful and costly in the short term, but long term? Institutional investors feel wooed. Think of regulations as veggies for Coinbase—nobody loves ’em, but they’re good for growing big and strong.

Innovation Station: Coinbase vs. Decentralized Wild West

Coinbase isn’t about to surrender to the rising armies of decentralized exchanges (DEXs). They’re doubling down, innovating furiously, and offering products from staking services to their crypto wallet. Coinbase decided the best way to beat decentralized financiers is to…join them? Yes! They’re bridging traditional crypto with decentralized finance (DeFi) principles like someone mixing peanut butter with chocolate—genius!

Security First, Party Second

You wouldn’t leave your cheesecake at an ant picnic, right? Well, Coinbase isn’t leaving your coins unguarded either. Cold storage vaults, two-factor authentication like Fort Knox, and insane encryption—they’re serious about security. They’ve even got bounty programs for hackers looking to help identify vulnerabilities. Imagine pirates hired by banks—that kind of awesome!

Diversifying Money Streams like an Entrepreneurial Octopus

Trading fees are great but unstable—like basing your budget on grandma’s lottery wins. Coinbase is smarter. They’re cashing in from subscription services like Coinbase Prime, staking, and custody solutions. Their new venture, Base, thrusts them squarely into the Web3 battleground.

Key Takeaways:

- Coinbase trades like crypto’s erratic mood-swing twin.

- Leveraged ETFs sound fun and terrifying all at once.

- Regulators are expensive headaches but worth it for future gains.

- Innovating like crazy keeps Coinbase ahead of decentralized rivals.

- Cybersecurity at Coinbase: fortified better than medieval castles.

- Revenue diversity? Coinbase loves it—it’s an entrepreneur at heart!

Wrapping Up: What’s Next for Coinbase!

Whether it’s dodging regulatory curveballs or launching innovative products, Coinbase remains at the thrilling center of crypto’s evolving universe. Keep an eye (and possibly an ETF) on Coinbase—validated by The Awesome Blog—as they slide into an exciting, unpredictable digital future. Stay tuned, stay awesome!

Leave a Reply